In the Seventeenth Century, the Japanese developed a method to analyze the price of rich contracts. This technique was called "Candlestick Charting." Today, Steven Nison is credited with popularizing the Candlestick Chart, and is recognized as the leading authority on interpretation of the system. Candlesticks are graphical representations of the price fluctuations of a product. A candlestick can represent any period of time. A currency trader’s software can provide charts representing time frames from five minutes, up to one week per candlestick.

There are no calculations required to interpret Candlestick Charts. They are a simple visual aid representing price movements in a given time period. Each candlestick reveals four vital pieces of information; the opening price, the closing price, the highest price and the lowest price the fluctuations during the time period of the candle. In much the same way as the familiar bar chart, a candle illustrates a given measure of time. The advantage of candlesticks is that they clearly denote the relationship between the opening and closing prices.

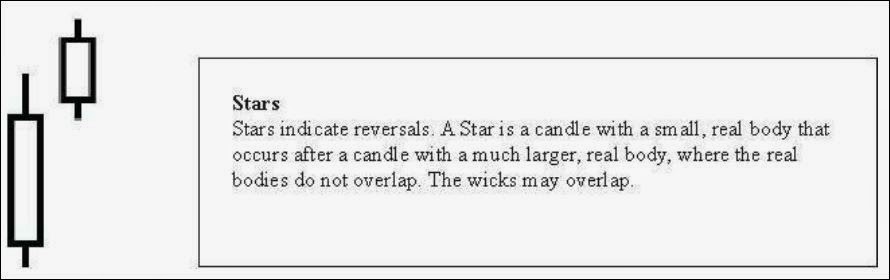

Because candlesticks display the relationship between the open, high, low and closing prices, they cannot be used to chart securities that have only closing prices. Interpretation of Candlestick Charts is based on the analysis of patterns. Currency traders predominantly use the relationship of the highs and lows of the candlewicks over a given time period. However, Candlestick Charts offer identifiable patterns that can be used to anticipate price movements.

There are two types of candles: The Bullish Pattern Candle and the Bearish Pattern Candle.

Source: The 10 Keys To Successful Trading

0 comments :

Post a Comment